Student Debt, Stock Market Rebound, Finances

Khaled A. Taha, AAMS ®

CEO & Managing Partner SAGE Private Wealth Group

Wealth Advisor, RJFS • 18W140 Butterfield Rd Ste 1160 • Oakbrook Terrace • IL • 60181 630-933-0000

khaled.taha@sageprivatewealth.com • www.SAGEprivatewealth.com

SAGE Update

We are excited to announce the launch of our new and improved website! SAGE Private Wealth Group is committed to delivering an excellent Client Experience and providing opportunities to share our ideas and educate our clients. The new site contains updated branding and design features that include our new logo, updated team member photos and new tools!This will allow for a more intuitive client experience and will allow for even greater ease of navigation. Visit www.sageprivatewealth.com to explore our new site.

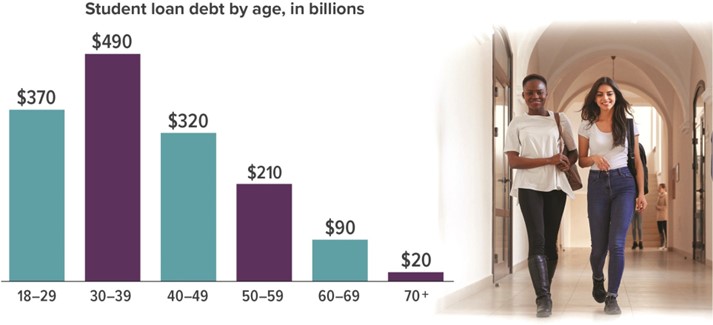

Student Debt: It’s Not Just for Young Adults

Recent college graduates aren’t the only ones carrying student loan debt. A significant number of older Americans have student debt, too. In fact, student loan debt is the second-highest consumer debt category after mortgage debt. In total, outstanding student loan debt in the United States now stands at approximately $1.5 trillion, with the age 30 to 39 group carrying the highest load

Source: New York Fed Consumer Credit Panel/Equifax (Q3 2019 data)

SAGE Global Market Perspective: Stock Market Rebound

Dear Clients,

As global equity markets continue their steady climb in the face of this unfathomable health and economic crisis, there is no wonder many investors are surprised. Although much of the initial rebound off the March 23rd low can be attributed to optimism surrounding COVID-19 containment efforts as well as the full and partial reopening of major economies including all fifty

U.S. states, we believe that there has been other major factors sustaining and improving stock market conditions over the past few months.

When comparing the performance of the eleven S&P 500 sectors, it is glaring that the rebound has not been broad-based. In fact, much of the rebound can be attributed to the performance of the healthcare and technology sectors, both of which are up double digit percentage points over the previous twelve months. Furthermore, tech giants such as Amazon.com, Facebook and Netflix have helped buoy the consumer discretionary and communications services sectors. Although these few names are not the only stocks experiencing new highs, it is important to note that their market caps are some of the largest in the S&P 500 Index, and for better or for worse, highlighting their importance. However, as of late, optimism around reopening and a relatively quick recovery in oil prices has recently shown signs of life in lagging sectors.

Another major factor to consider when attempting to square the stock market rebound to deteriorating economic conditions is the fact that in order for a stock to be added to the S&P 500 Index, it must be a large corporation that serves many individuals and business. However extremely unfortunate, the pandemic has forced many small businesses to close, deeming their operations as non-essential, whereas companies such as Walmart, Costco, Target and Home Depot were able to keep their doors open. As the SAGE Investment Committee reflects on the aftermath of the March 2020 selloff, we believe that the stock market had significantly over estimated the decline of corporate profits, briefly disregarding the size, strength and resilience of our publicly traded companies.

Besides the performance of individual sectors and stocks, we believe that the Federal Reserve’s unprecedented accommodation is another major factor sustaining and improving the U.S. equity market. Unlike the quantitative easing programs in response to the 2008 financial crisis, where the Federal Reserve funded excess reserves of our major financial institutions, the massive amounts of money that the Federal Reserve is currently creating is being pumped directly into the economy. We are witnessing through a significant increase in commercial and industrial loans, much of which is being facilitated by the Paycheck Protection Program. Understanding that the purpose of PPP is to maintain payroll costs and avoid a complete economic meltdown, we believe that the massive increase in the money supply is another major factor fueling equity markets

Although we remain confident in corporate America’s ability to weather this storm and encouraged by the Federal Reserve’s willingness to provide liquidity to the economy, we are closely watching consumer behavior during this phased reopening process to gauge the speed and strength of the economic recovery. For this reason, we are content maintaining a larger than usual allocation to risk control assets, and we are confident that our longstanding preference for U.S. growth oriented stocks will continue to enable portfolios to meaningfully participate in rallies during this period of heightened volatility.

If anything in your circumstances should change, please be certain to share that and other new information with your Wealth Advisor.

Kind regards,

SAGE Investment Committee

Mid-Year Is a Good Time to Fine-Tune Your Finances

The first part of 2020 was rocky, but there should be better days ahead. Taking a close look at your finances may give you the foundation you need to begin moving forward. Mid-year is an ideal time to do so, because the planning opportunities are potentially greater than if you waited until the end of the year.

Renew Your Resolutions

At the beginning of the year, you may have vowed to change your financial situation, perhaps by saving more, spending less, or reducing your debt. Are these resolutions still important to you? If your income, expenses, and life circumstances have changed since then, you may need to rethink your priorities.

While it may be difficult to look at your finances during turbulent times, review financial statements and account balances to determine whether you need to make any changes to keep your financial plan on track.

Take Another Look at Your Taxes

Completing a mid-year estimate of your tax liability may reveal planning opportunities. You can use last year’s tax return as a basis, then factor in any anticipated adjustments to your income and deductions for this year.

Check your withholding, especially if you owed taxes or received a large refund. Doing that now, rather than waiting until the end of the year, may help you avoid a big tax bill or having too much of your money tied up with Uncle Sam.

You can check your withholding by using the IRS Tax Withholding Estimator at irs.gov. If necessary, adjust the amount of federal or state income tax withheld from your paycheck by filing a new Form W-4 with your employer.

Review Your Investments

Review your portfolio to make sure your asset allocation is still in line with your financial goals, time horizon, and tolerance for risk. Look at how your investments have performed against appropriate benchmarks, and in relationship to your expectations and needs. Changes may be warranted, but be careful about making them while the market is volatile.

Asset allocation is a method used to help manage investment risk; it does not guarantee a profit or protect against investment loss. All investing involves risk, including the possible loss of principal and there is no guarantee that any investment strategy will be successful.

Check Your Retirement Savings

If you’re still saving for retirement, look for ways to increase retirement plan contributions. For example, if you receive a pay increase this year, you could contribute a higher percentage of your salary to your employer-sponsored retirement plan, such as a 401(k), 403(b), or 457(b) plan. If you’re age 50 or older, consider making catch-up contributions to your employer plan. For 2020, the contribution limit is

$19,500, or $26,000 if you’re eligible to make catch-up contributions. If you are close to retirement or already retired, take another look at your retirement income needs and whether your current investment and distribution strategy will provide enough income.

Read About Your Insurance Coverage

What are the terms of your homeowners, renters, and auto insurance policies? How much disability or life insurance coverage do you have? Your insurance needs can change; make sure your coverage has kept pace with your income or family circumstances.

More to Consider

Here are some other questions you may want to ask as part of your mid-year financial review.

The ABCs of Finance: Teaching Kids About Money

It’s never too soon to start teaching children about money. Whether they’re tagging along with you to the grocery store or watching you make purchases online, children quickly realize that we use money to buy the things we want. You can teach some simple lessons today that will give them a solid foundation for making a lifetime of sound financial decisions.

Start with an Allowance. An allowance is often a child’s first brush with financial independence and a good way to begin learning how to save money and budget for the things they want. How much you give your children will depend in part on what you expect them to buy and how much you want them to save. Make allowance day a routine, like payday, by giving them a set amount on the same day each week or month.

Help Them Set Financial Goals. Children might not always appreciate the value of putting money away for the future. Help them set age-appropriate short- and long-term financial goals that will serve as incentives for saving money. Write down each goal and the amount that must be saved each day, week, or month to reach it.

Let Them Practice. As children get older, they can become more responsible for paying other expenses (e.g., clothing, entertainment). The possibility of running out of money between allowance days might make them think more carefully about their spending habits and choices and encourage them to budget more effectively.

Take It to the Bank. Piggy banks are a great way to start teaching young children to save money, but opening a bank savings account will reinforce lessons on basic investing principles such as earning interest and the power of compounding. Encourage your children to deposit a portion of any money they receive from an allowance, gift, or job into their accounts.

This information, developed by an independent third party, has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Investing involves risk and you may incur a profit or loss regardless of strategy selected. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. This information is not intended as a solicitation or an offer to buy or sell any security referred to herein. Investments mentioned may not be suitable for all investors. The material is general in nature. Past performance may not be indicative of future results. Raymond James does not provide advice on tax, legal or mortgage issues, these matters should be discussed with the appropriate professional. Securities are offered through Raymond James Financial Services, Inc., member FINRA/SIPC, an independent broker/dealer, and are not insured by FDIC, NCUA or any other financial institution insurance, are not deposits or obligations of the financial institution, are not guaranteed by the financial institution, and are subject to risks, including the possible loss of principal.If you prefer not to receive this correspondence, please let us know via email.

SAGE Private Wealth Group is not a registered broker/dealer and is independent of Raymond James Financial Services, Inc., member FINRA / SIPC. Securities offered through Raymond James Financial Services, Inc., member FINRA / SIPC. Investment Advisory Services offered through Raymond James Financial Services Advisors, Inc. and SAGE Private Wealth Group.

Any opinions are those of the SAGE Investment Committee and not necessarily those of RJFS or Raymond James.