SAGE Global Market Perspective: Tug-Of-War

Khaled A. Taha, AAMS ®

CEO & Managing Partner SAGE Private Wealth Group

Wealth Advisor, RJFS • 18W140 Butterfield Rd Ste 1160 • Oakbrook Terrace • IL • 60181 630-933-0000

khaled.taha@sageprivatewealth.com • www.SAGEprivatewealth.com

SAGE Update

After 5 successful years with SAGE Private Wealth Group, Jacqueline Cornwell will be leaving SAGE on July 2nd. Jacqueline has been a valued member of the SAGE team and a consummate advocate for SAGE, our culture and values. We greatly appreciated the investment she made into building relationships with the team, and our clients and strategic partners. We wish Jacqueline the best success in her future endeavors!

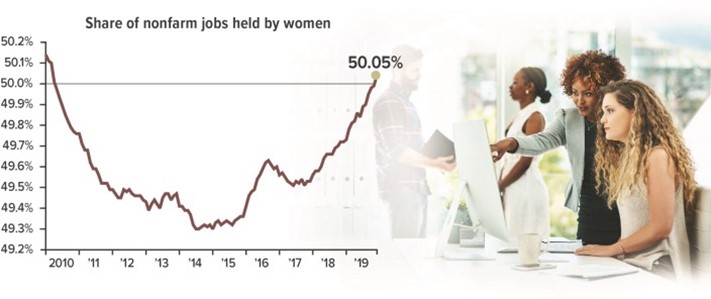

New Twist in the Labor Market

In December 2019, women outnumbered men in the U.S. workforce for the first time since April 2010, when layoffs due to the recession disproportionately affected male workers. A larger percentage of men age 16 and older (69.2%) are participating in the workforce than women (57.7%). However, there are more women than men in the population, and big industries such as health and education are keeping more of them in the workforce.

Source: U.S. Bureau of Labor Statistics, 2019

Considering the continued move higher in global equity markets, from the late March lows, it is clear that the aggressive measures taken by fiscal and monetary policymakers has been well received by stock market investors. However, with daily flare-ups of COVID-19 and several states either postponing or pushing back their reopening plans, market volatility is still the order of the day.

On the economic front, the abundance of data, both positive and negative, serves up daily reminders of the uncertain times in which we are living. The extremes are almost unprecedented. One day the world is anticipating new highs, the next day is Armageddon.

And while we understand that it can be difficult to remain optimistic in the face of these competing excesses, where there is no consensus or middle ground, we do see glimmers of hope suggesting that things are, in fact, getting better, albeit slowly.

Instinctively and logically we know that there is light at the end of the pandemic tunnel, but at the same time understand that the near-term unknowns have the ability to derail investors from their long-term convictions.

Some people are naturally wired to filter out the media circus whose sole intention, it often seems, is to capture and control our opinions. Others may be more sensitive to the constant stream of noise and clamor and thus more susceptible to the inevitable feelings of elation, uncertainty, hope and fear that these current events foster. As it all relates to the work that we do for you, our clients, rather than allowing market volatility impact ones financial well-being, we believe that aligning portfolios with investors’ stated and evolving long-term goals provides us, as it should you, with unwavering confidence and in a way that no market condition or media talking head can equal.

We believe that among those things that matter most is how much our private-sector income revives, and how quickly. Realistically, we may not see improvement on this front until the end of 2021, or longer, and for our real GDP to match prior highs.

As of today, it appears normalization will occur in fits and starts. Take solace knowing that we are confident that the U.S. economy will repair itself as will the capital markets.

Shorter-term, in the current state, our markets are focused on determining whether things are getting better or worse. That constant tug-of-war creates volatility. To reiterate, to us things appear to be improving ever so slightly even considering that COVID-19 is a bear that we will all be wrestling with for a while. Adopting a longer-term perspective, we are fortunate to live in a country where free-markets and capitalistic spirits are welcomed and in fact celebrated, where entrepreneurs and innovators work tirelessly to make our lives better, each competing for our hearts and our business. Capital is like water, it is always in

motion, flowing to opportunities, finding a way. So while brick and mortar retailers have taken a hit, for example, the companies with the best and most robust digital online solutions have experienced an acceleration in their success. While movie theatres have been empty for months, Netflix has experienced an enormous increase in their subscriber base. There will be losers and winners and forever the landscape will change.

Deliberate and thoughtful decision making, balancing risk with opportunity, is as important now as it ever has been.

For these reasons, and given the current environment, we are comfortable maintaining a sizable allocation to risk control securities, such bonds and cash, and we are confident that our longstanding preference for U.S. growth oriented stock exposure will continue to enable portfolios to meaningfully participate in rallies during this period of heightened volatility.

If anything in your circumstances should change, please share that and other new information with your Wealth Advisor.

Kind regards,

SAGE Investment Committee

Tapping Retirement Savings During a Financial Crisis

As the number of COVID-19 cases began to skyrocket in March 2020, Congress passed the Coronavirus Aid, Relief, and Economic Security (CARES) Act. The legislation may make it easier for Americans to access money in their retirement plans, temporarily waiving the 10% early-withdrawal penalty and increasing the amount they could borrow. Understanding these new guidelines and the other rules for loans and early withdrawals may help you determine if they are appropriate options during a financial crisis. (Remember that tapping retirement savings now could risk your financial situation in the future.)

Penalty-Free Withdrawals

The newest exception to the 10% early-withdrawal penalty allows IRA account holders and retirement plan participants to take distributions of up to $100,000 in 2020 for a “coronavirus-related” reason.* These situations include a diagnosis of COVID-19 for account owners and certain family members; a financial setback due to a quarantine, furlough, layoff, or reduced work hours, and in the case of business owners, due to closures or reduced hours; or an inability to work due to lack of child care as a result of the virus. This temporary exception augments the other circumstances for which a penalty-free distribution is typically allowed:

- Death or disability of the account owner

- Unreimbursed medical expenses exceeding 7.5% of adjusted gross income (increases to 10% in 2021)

- A series of “substantially equal periodic payments” over your life expectancy or the joint life expectancy of you and your spouse

- Birth or adoption of a child, up to $5,000 per account owner

- Certain cases when military reservists are called to active duty

In addition, IRAs (but not work-based plans) allow penalty-free withdrawals for a first-time home purchase ($10,000 lifetime limit), qualified

higher-education expenses, and payments of health insurance premiums in the event of a layoff.

Work-based plans allow exceptions for those who separate from service after age 55 (50 in the case of qualified public safety employees) and distributions as part of a qualified domestic relations order.

Tax Consequences

Penalty-free does not mean tax-free, however. In most cases, when you take a penalty-free distribution, you must report the full amount of the distribution on your income tax return for that year. However, the income associated with a coronavirus-related distribution can be spread over three years for tax purposes, with up to three years to reinvest the money.1

Retirement Plan Loans

If your work-based retirement plan allows loans, you typically can borrow up to the lesser of 50% of your vested balance or $50,000. Most loans must be repaid within five years, but if the money is used to purchase a primary residence, the repayment period may be longer. The CARES Act permits employers to increase this amount to the lesser of 100% of the vested balance or $100,000 for loans to coronavirus-affected individuals made between March 27, 2020, and September 22, 2020.* Affected participants who have outstanding loans on or after March 27, 2020, will be able to delay any payments due in 2020 by one year.2

Hardship Withdrawals

Many work-based retirement plans also permit hardship withdrawals in certain circumstances. Although these distributions are not exempt from the 10% early-withdrawal penalty, they can be a lifeline for people who need money in an emergency.

For more information about your options, contact your IRA or retirement plan administrator.

*Employers do not have to adopt the new withdrawal and loan provisions.

1) Amounts reinvested may reduce your tax obligation on the distributions; however, due to the timing of distributions and required tax filings, you may have to file an amended return to seek a refund on any taxes previously paid on withdrawn amounts. 2) The original five-year repayment period will be extended for the delay, but interest will continue to accrue. 3) Source: Plan Sponsor Council of America, 2019 (2018 data)

Five Industries Most Likely to Offer Retirement Plan Loans

Percentage of plans that offer loans, by type of industry3

Debit or Credit? Pick a Card

Americans use debit cards more often than credit cards, but they tend to use credit cards for

higher-dollar transactions. The average value of a debit-card transaction in 2018 was just $36, while credit-card transactions averaged $89.1

This usage reflects fundamental differences between the two types of cards. A debit card acts like a plastic check and draws directly from your checking account, whereas a credit-card transaction is a loan that remains interest-free only if you pay your monthly bill on time. For this reason, people may use a debit card for regular expenses and a credit card for “extras.” However, when deciding which card to use, you should be aware of other differences.

Fraud protection. In general, you are liable for no more than $50 in fraudulent credit-card charges. For debit cards, a $50 limit applies only if a lost card or PIN is reported within 48 hours. The limit is $500 if reported within 60 days, with unlimited liability after that. A credit card may be safer in higher-risk situations, such as when shopping online, when the card will leave your sight (as in a restaurant), or when you are concerned about the security of a card reader. If you regularly use a debit card in these situations, you may want to maintain a lower checking balance and keep most of your funds in savings.

Merchant disputes. You can dispute a credit-card charge before paying your bill and shouldn’t have to pay it while the charge is under dispute. Disputing a debit-card charge can be more difficult when the charge has been deducted from your checking account, and it may take some time before the funds are returned.

Rewards and extra benefits. Debit cards offer little or no additional benefits, whereas some credit cards offer cash-back rewards, and major cards may include extra benefits such as travel insurance, extended warranties, and secondary collision and theft coverage for rental cars (up to policy limits). Of course, if you do not pay your credit-card bill in full each month, the interest you pay can outweigh any financial rewards or benefits.

Credit history. Using a credit card can affect your credit score positively or negatively, depending on how you use it. A debit card does not affect your credit score.

Considering the additional protections and benefits, a credit card may be a better choice in some situations — but only if you pay your monthly bill on time.

1) Federal Reserve, 2019

This information, developed by an independent third party, has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Investing involves risk and you may incur a profit or loss regardless of strategy selected. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. This information is not intended as a solicitation or an offer to buy or sell any security referred to herein. Investments mentioned may not be suitable for all investors. The material is general in nature. Past performance may not be indicative of future results. Raymond James does not provide advice on tax, legal or mortgage issues, these matters should be discussed with the appropriate professional. Securities are offered through Raymond James Financial Services, Inc., member FINRA/SIPC, an independent broker/dealer, and are not insured by FDIC, NCUA or any other financial institution insurance, are not deposits or obligations of the financial institution, are not guaranteed by the financial institution, and are subject to risks, including the possible loss of principal.If you prefer not to receive this correspondence, please let us know via email.

SAGE Private Wealth Group is not a registered broker/dealer and is independent of Raymond James Financial Services, Inc., member FINRA / SIPC. Securities offered through Raymond James Financial Services, Inc., member FINRA / SIPC. Investment Advisory Services offered through Raymond James Financial Services Advisors, Inc. and SAGE Private Wealth Group.

Any opinions are those of the SAGE Investment Committee and not necessarily those of RJFS or Raymond James.